Chưa phân loại

Shell out By the Cellular phone Gambling enterprises Gamble from the Greatest Mobile Charging you Internet sites

Blogs

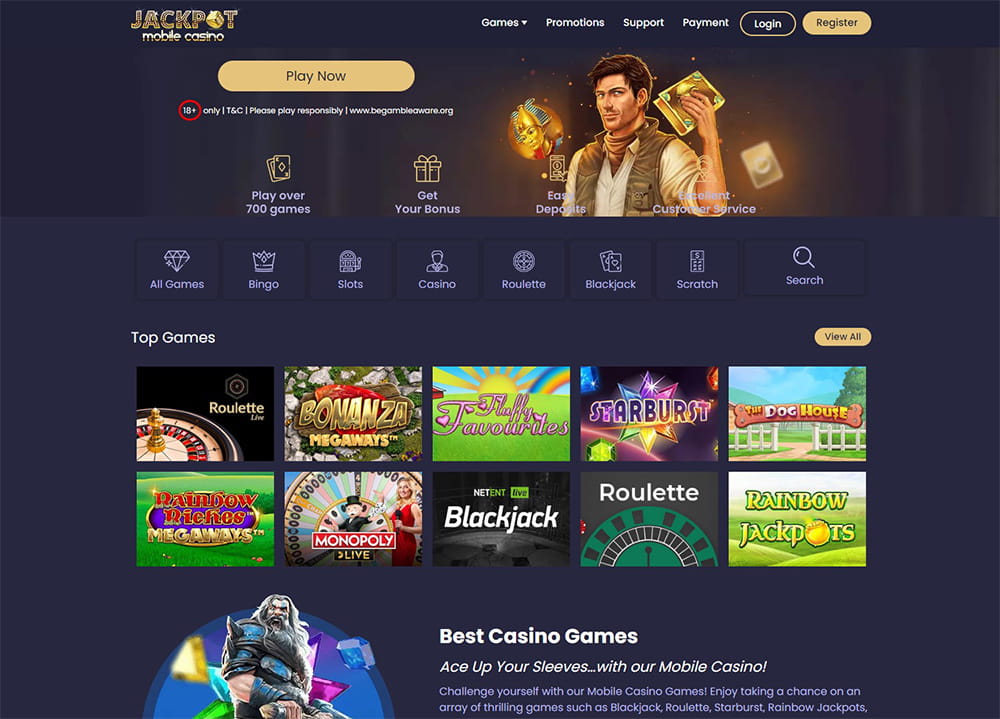

Really cellular casinos within the 2024 allow you to claim special incentives (both for the new and you may typical participants) when you use the fresh pay by cellular phone statement option. It’s always a good tip to read through the new promo T&Cs carefully basic even when, and there’s some offers where just particular payment steps is also be used to claim. E-wallets such Skrill and Neteller usually are excluded from bonuses. By using the shell out from the cellular telephone costs choice in the casinos on the internet are really easy. Fundamentally, all of that goes is that you’re recharged to suit your internet casino deposit during your cellular telephone bill.

This is going to make them preferred certainly visitors and pupils out of its hometowns. Concurrently, he could be popular with moms and dads who would like to features a way to stay linked to the college or university decades students and possess certain control of the expense. If you are later to the a cellular phone commission, enable it to be a top priority to get latest to your account just before the company sends they to help you choices or fees it well. With many credit scoring habits, later mobile costs will not have an effect on your credit rating unless of course the fresh account would go to selections or perhaps the provider costs from the debt. Yes, i retreat’t seen one Spend Because of the Mobile gambling establishment that will not accept cards, discounts and even some cryptocurrencies since the payment steps.

And we understand the rage away from waiting for exactly what seems like an awkwardly much time period of time until the transaction is eligible and you will get rid of the card. With your cell phone to expend in store otherwise create costs on the internet is fairly simple, but there are many steps you need to take to install faucet-to-pay on your cell phone the very first time. To begin with having Apple Pay, open the brand new Purse app that comes pre-attached to your own iphone 3gs and you may range from the cards you want to utilize.

Make sure to read the casino’s minimum/ limit put limitations beforehand (more details less than). Per spend-by-mobile phone gambling enterprise goes through comprehensive opinion because of the no less than a couple of our team’s publishers, making https://mrbetlogin.com/jungle-books/ certain that the newest casinos we recommend is genuine or more to go out. Anywhere on the high street which takes contactless cards and also have provides an apple Pay, Yahoo Pay otherwise Samsung Shell out symbol works with, as well as Marks and you can Spencer, Lidl, Pizza Share and you may Boots. SumUp is actually PCI-DSS certified, and its particular card audience try certified from the PCI, EMV, Mastercard and you will Visa. You could arrive at support service by the mobile phone twenty four/7, otherwise by the cellular phone, current email address, real time cam otherwise Facebook. For individuals who’d want to troubleshoot an issue yourself, the business will bring numerous information so you can, and instructions and training, a searchable knowledgebase, a person discussion board, and a website.

In the a fellow-to-peer cellular commission, you may be and make an e-transfer via your bank in order to, state, spend a friend back for dinner otherwise somebody for the Craigslist to have a piece of chairs. Within the a cellular payment in the a brick-and-mortar team, you’re having fun with a software on your own mobile device—rather than dollars or a credit—to fund certain goods or functions at the checkout prevent. In this instance, the business would want a particular sort of part-of-selling device (which we have to the less than) in order to processes the order.

Mobile mastercard processing is all the more extensive, that have cellular section of product sales (mPOS) tech currently rising. For those who’lso are interested in learning tips undertake mobile charge card money to possess home business, we’ve got your shielded. Learn all you need to understand to accept card repayments on the a telephone, here. Out of your SumUp membership web page, you can include personnel for you personally. For each and every employee features her log in history, and certainly will take on charge card repayments and find out the conversion process histories.

- For each employee provides their own sign on credentials, and can deal with bank card payments and see its conversion process records.

- Spending, bitcoin requests, and you may tax processing are convenient and rewarding have for inside a mobile fee application.

- Having fun with Payanywhere’s cellular credit viewer for the app enables you to thing electronic receipts, manage list, staff and you may people and you may allows you to tune conversion.

- That’s where a new sequence out of number, titled a good token, is made for that one to-day exchange.

- Samsung Shell out provides powerful mobile percentage functions you to definitely gamble nice with the company’s of a lot products and you may things.

But not, if you want more has, you may want to pick one of your own repaid agreements. So it free provider preserves your percentage answers to automatically spend your own T-Mobile statement by the subtracting payments from the mastercard or examining membership. Small business owners are always seeking the most economical way to get work done.

Many of the better gambling applications in the us tend to maybe not costs transaction charges in making dumps and withdrawals. With this particular being told you, browse the fine print to the bookies with your favorite deposit method. Along with having a limit on the restriction dumps, your won’t have the ability to cash out utilizing the spend by cellular telephone means. You should find an alternative financial option to withdraw their earnings. After you create a cellular put, you might choose to enjoy any games in the local casino’s library.

How can you handle productivity when it comes to mobile money?

The biggest mobile fee experience Apple Spend, which makes it quite simple to have apple’s ios users so you can deposit instantly. Contain to a couple of years from percentage history out of this service membership business of your choice on the credit rating, possibly boosting your credit history. Cellular phone company will even look at the borrowing if you want to invest in another cellular telephone. Of a lot cellular telephone companies today require that you buy otherwise book a different cellular phone. In any event, you will probably get a fees plan for your new mobile phone with small monthly payments added to their monthly provider payment. According to issues that come with costs and convenience, i encourage cellular card customers from Square, Clover and you can PayPal.

During the last few years, Jenn has triggered Forbes Coach and you may a variety of fintech organizations. She’s offered because the an excellent UX representative, moderated conversations on the unlock banking and been an invitees to the a great quantity of private fund podcasts. But not, you’ll find three major mobile wallets designed for particular sort of products. To your card selected, make certain the label via Reach ID, Face ID otherwise their passcode.

Whenever can also be contactless mobile phone money be useful?

With only your valid SA ID book, Evidence of address no over the age of ninety days, SA phone number, current email address and you may a deposit count, we’ll approve your application fast. Get 1 year of more shelter for your smartphone which have lengthened guarantee provider. Spend because of the cell phone costs, also known as spend by mobile, has been seeking to get into sportsbooks.

Good for Shopping online

Pursuing the PayPal’s best practices to have providers decreases the probability of having your money held inside a reserve membership. In addition to make sure that these products otherwise functions your business brings is actually inside PayPal’s appropriate play with rules; if you don’t, your financing may be suspended or your account signed without warning. To promote its QR password payments, PayPal is charging you a reduced price away from 2.2% of each and every QR password deal up until March 29, 2021.